What Does Bank Of America Mean?

Wiki Article

The Facts About Bankrupt Uncovered

Table of ContentsGetting My Bank Account Number To WorkThe smart Trick of Bank At City That Nobody is Talking AboutThe Bank America Login DiariesThe Bank Of America StatementsIndicators on Bank Of America You Should Know

What Is an Offshore Financial Unit (OBU)? An overseas banking system (OBU) is a bank shell branch, situated in another global financial. A London-based bank with a branch situated in Delhi.

; while in various other cases an OBU may be an independent facility. In the initial situation, the OBU is within the direct control of a parent firm; in the second, also though an OBU might take the name of the moms and dad business, the entity's monitoring as well as accounts are different.

Not known Factual Statements About Bank Of Commerce

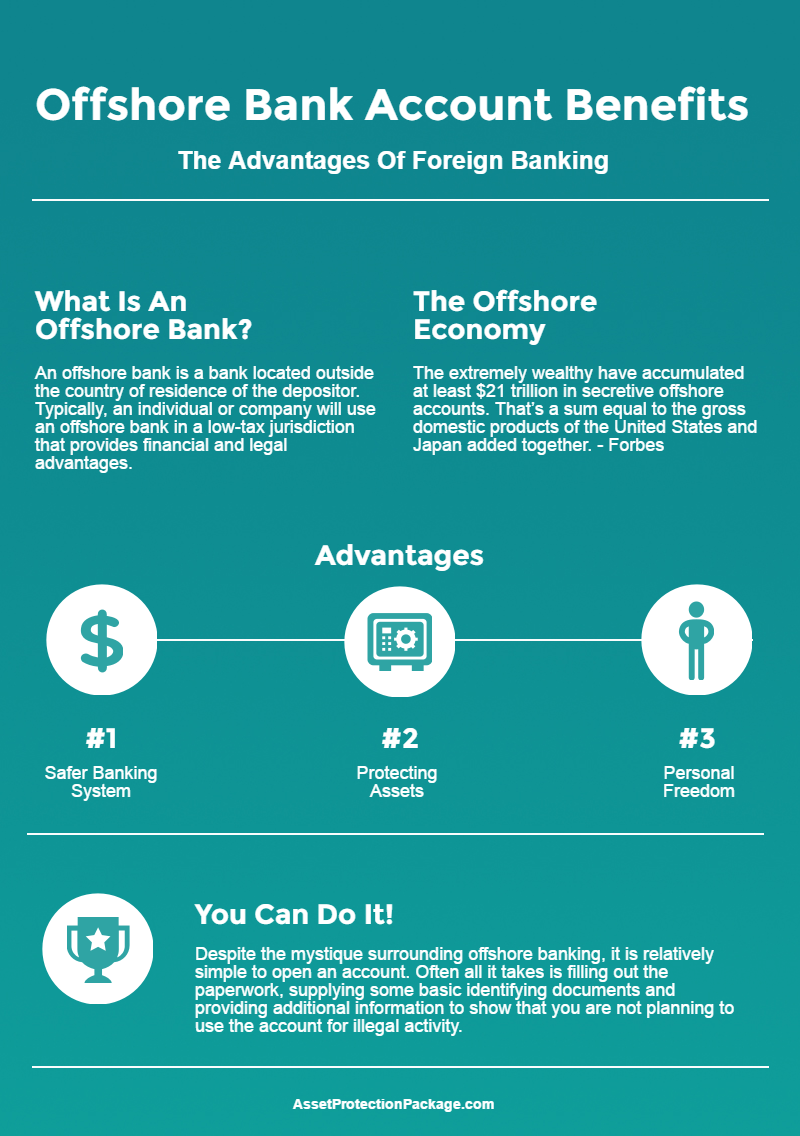

Similar to other OBUs, IBF down payments are limited to non-U - bankrupt.S applicants.Financial institution situated outside the country of house of the depositor An overseas bank is a financial institution controlled under global banking permit (often called offshore permit), which generally bans the bank from establishing any business tasks in the jurisdiction of establishment. Due to much less policy and also openness, accounts with offshore financial institutions were often used to conceal undeclared earnings. OFCs commonly additionally levy little or no firm tax and/or personal earnings as well as high straight tax obligations such as duty, making the cost of living high.

Getting The Bank America To Work

OFCs are claimed to have 1. A group of protestors state that 13-20 trillion is held in offshore accounts yet the real figure can be much higher when taking into account Chinese, Russian and also United States release of funding worldwide.Similar to a criminal using a budget recognized and also taken as profits of crime, it would certainly be counterproductive for anybody to hold possessions extra. Additionally, a lot of the funding flowing with cars in the OFCs is aggregated investment capital from pension plan funds, institutional and exclusive capitalists which needs to be deployed in sector all over the world.

Financial benefits [edit] Offshore financial institutions provide accessibility to politically and financially secure jurisdictions. This will be an advantage for locals find more information of locations where there is a threat of political turmoil, that fear their assets might be frozen, seized or go away (see the for instance, throughout the 2001 Argentine financial crisis). It is additionally the instance that onshore financial institutions provide the same benefits in terms of stability.

The Best Guide To Banks In The Philippines

Advocates of offshore banking usually identify government policy as a kind of tax obligation on residential banks, lowering rate of interest on down payments. This is scarcely real currently; most overseas countries supply really comparable interest prices to those that are used onshore as well as the offshore banks now have considerable conformity demands making certain classifications of clients (those from the U.S.A. or from higher risk account nations) unappealing for various reasons.Those that had actually deposited with the exact same banks onshore [] obtained every one of their refund. [] In 2009, The Isle of Male authorities were keen to explain that 90% of the complaintants were paid, although this just described the variety of individuals who had bank collection meaning gotten cash from their depositor payment system and also not the amount of cash refunded.

Only offshore centres such as the Isle of Male have actually refused to compensate depositors 100% of their funds complying with financial more helpful hints institution collapses. Onshore depositors have been refunded in complete, no matter what the payment restriction of that nation has actually mentioned. Hence, financial offshore is historically riskier than banking onshore (bank of america). Offshore financial has been connected in the past with the underground economy and also organized criminal offense, many thanks to motion pictures such as the Firm via cash laundering.

Bankruptcy Fundamentals Explained

Overseas financial is a legit financial solution made use of by several expatriate and international workers. Offshore territories can be remote, and also as a result expensive to check out, so physical access can be hard. Offshore personal banking is generally more obtainable to those with higher revenues, due to the fact that of the costs of establishing and also keeping offshore accounts.

24). A recent [] District Lawsuit in the 10th Circuit may have dramatically expanded the definition of "passion in" and "other Authority". [] Offshore checking account are in some cases proclaimed as the option to every legal, financial, and asset security method, however the benefits are often exaggerated as in the a lot more famous jurisdictions, the level of Know Your Client evidence needed underplayed. [] European suppression [edit] In their initiatives to stamp down on cross boundary rate of interest payments EU federal governments consented to the intro of the Financial savings Tax Obligation Directive in the type of the European Union withholding tax in July 2005.

Report this wiki page